Although the wine category in the US holds an 11% volume share – equal to that of spirits – the category’s future is facing a number of challenges. Wine volumes in the US are expected to continue on a downward trajectory, especially as RTDs and spirits steal share. Changes in consumer priorities and habits mean that wine brand owners need to re-engage with an audience that’s increasingly older and more affluent, and one that is seeking more premium and interesting wines, according to Wine Intelligence.

Wine drinkers skew older, richer

Growth of RTDs and spirits, plus the impact of Covid-19, has led to a loss of close to 15% of the regular wine drinking population in the US between 2018 and 2021. Those leaving the category are mainly younger legal drinking age (LDA+) consumers and those on lower incomes; those who remain are skewing older and more affluent.

Younger LDA consumers are withdrawing from the wine category for a number of key reasons. “Closing the on-premise during Covid shut down a key channel for younger LDA+ consumers to encounter wine – a key channel for their previous consumption of wine at social settings,” remarks Richard Halstead, COO Wine Intelligence, a division of IWSR Group.

The moderation trend is leading to a narrowing of beverage repertoires as well. “With consumers not drinking as often, when they do, they tend to choose their favorites over something they rarely drink,” comments Halstead.

Brandy Rand, COO Americas IWSR, adds that in the U.S., still wine continues to lose volume share to the spirits and hard seltzer categories. “Recent wine launches, such as Fitvine (Fitvine), Kendall Jackson Avant (Jackson Family Wines), BABE 100 (AB InBev), Bota Box Breeze (Delicato), Cupcake Light Hearted (The Wine Group), and Kim Crawford Illuminate (Constellation), have increasingly focused on health and wellness attributes, as well as more convenient and portable packaging, in order to help generate interest in the wine category,” notes Rand.

Premiumization trend continues

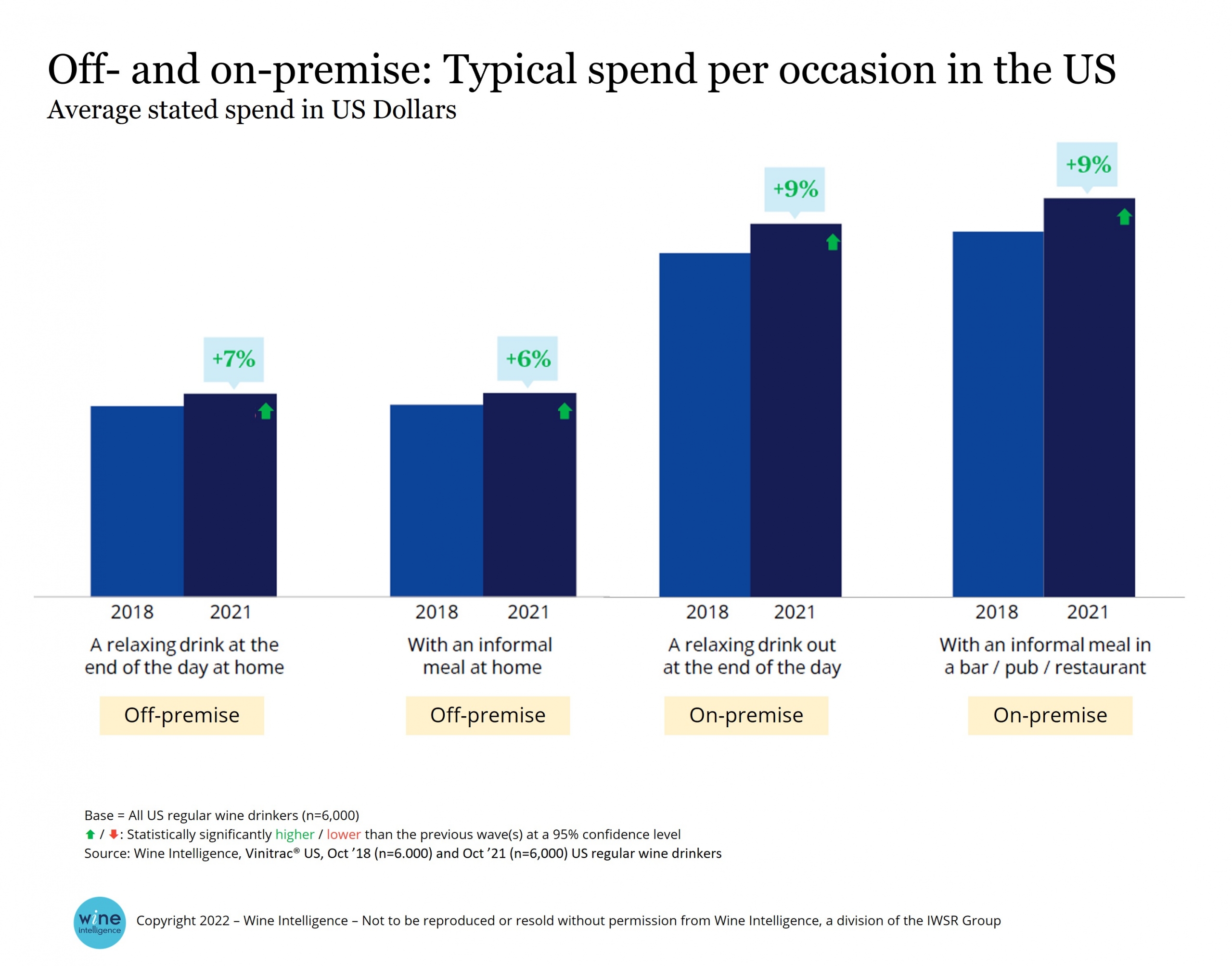

Wine spending has increased across all occasions, and Premium+ categories are expected to lead growth over the next four years as under-$10 wine volumes decline further, Wine Intelligence says. An increasing skew towards affluent consumers suggests that regular wine drinkers will be better insulated from rising living costs and inflation. While wine volumes will likely continue on their downward trajectory, value will continue to grow, especially as wine becomes more interesting to a more affluent, urban elite customer segment, and to over-55s generally.

Many wine brand owners have shifted focus to the premium-end of their portfolios. In 2019, for example, Constellation Brands announced it would be selling off many of its lower-end wine brands – mostly those that cost under $11 a bottle – to E&J Gallo. In 2021, Delicato Family Wines completed its purchase of the Francis Ford Coppola winery, and Treasury Wine Estates also announced its acquisition of Napa Valley luxury winery, Frank Family Vineyards.

Evidence of on-premise revival

Recalled wine consumption in on-premise has bounced back in terms of both participation rates and frequency. Going forward, trade experts believe the main on-premise wine-volume constraint is supply side: stock in sit-down restaurants reduced because of Covid-era economic shock, plus ongoing labor shortages.

The ecommerce channel will continue to attract a wider audience and more frequent participation, thanks to deepening investment from the supply chain. Consumer usage levels of ecommerce surged in 2020 and have held their ground in 2021, while mainstream B&M retail has seen declining wine buyer footfall.

Wine knowledge declining

Objective knowledge continues to decrease over time among regular wine drinkers in the U.S., part of a wider global trend and likely due to the broader access to online information such as wine apps and reviewing platforms, a process known as cognitive offloading, Wine Intelligence said.

Canned wine usage increasing

Wine in cans has doubled its audience since 2018, a growth largely supported by the younger LDA consumers in the segment. 40% of Millenials who are aware of canned wine have bought this type of packaging vs. 22% of all wine drinkers and just 8% of Boomers. Smaller pack sizes such as wine in cans and smaller-format bottles will likely make further inroads in 2022, though this format remains a minority interest (mainly among under 40s) and volumes are currently small.

More attention for natural wine

Sustainability and low-intervention wines are creeping up in popularity, and will continue to advance this year, particularly among Millennials.

Two in five consumers are aware of natural wine, and 16%of consumers say they bought natural wine in 2021. It is the only alternative wine type that has experienced an increase in purchase incidence since 2020. The main audience is Millennials, followed by Gen X.

Key take-aways for brand owners

As the on-premise continues to rebound, brand owners should evaluate their re-engagement strategy and how to position their brands in the on-premise, as well as how to prompt (re)trial in the off-premise through POS and social media. For brands focusing on the premium-end, positioning for success in the premium $20+ off-premise segment will be key. Brand owners will also need to consider their strategy for connecting with people who are not sure if wine is for them anymore. Simplifying the wine education will help engage consumers.