How has Covid changed the relationship that premium wine drinkers have with wine?

U.S. premium drinkers have broadly maintained their consumption levels since 2019, despite the restrictions and behavior changes resulting from Covid, says Wine Intelligence.. In fact, average spend per bottle in both the off- and on-premise has been largely stable since 2019.

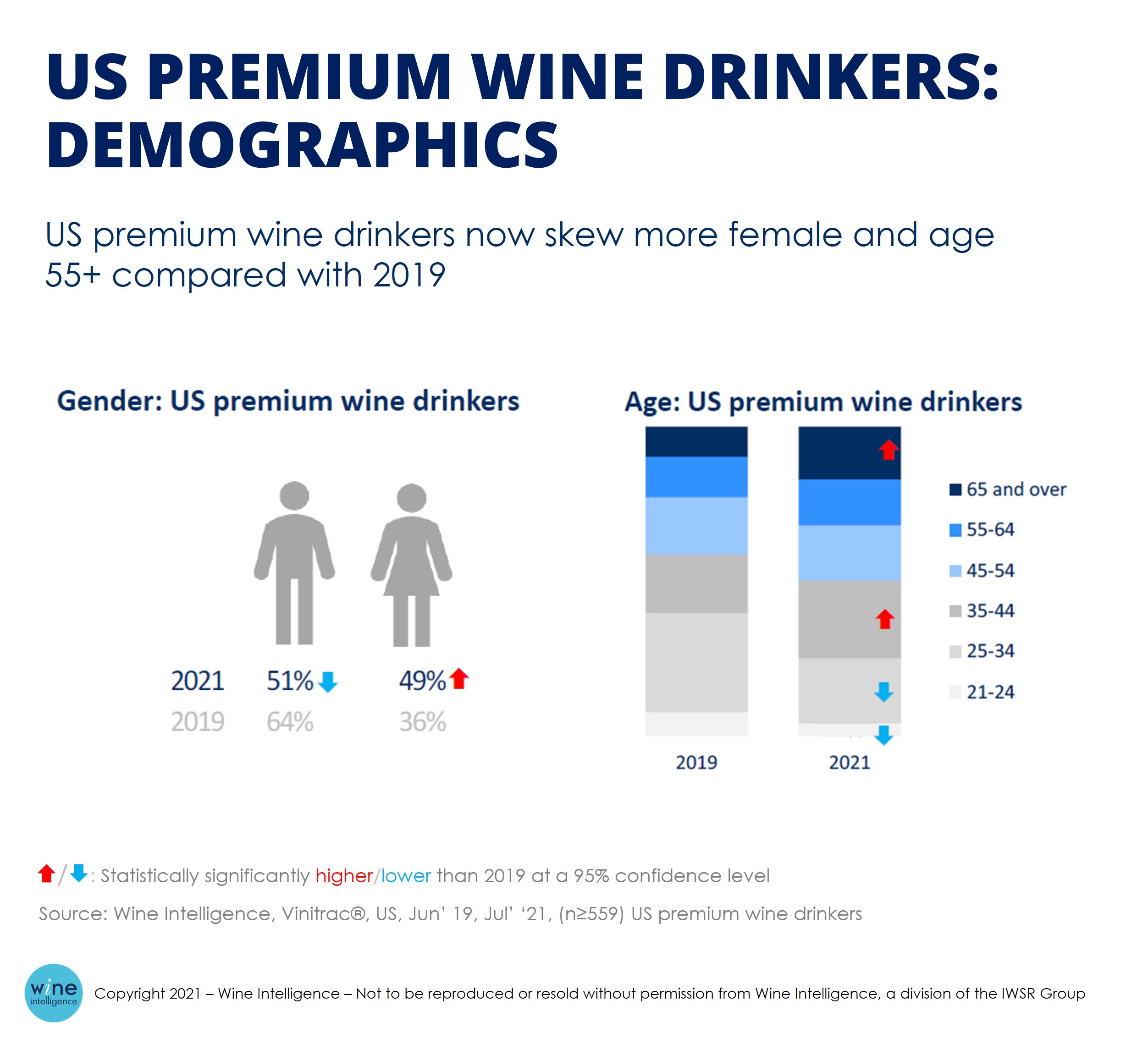

Where changes arise however, is in the demographics of the premium wine drinker segment, which is now increasingly both female and older. As of 2021, 49% of premium wine drinkers in the U.S. are women, up from 36% of premium wine drinkers in 2019. Additionally, paralleling the ‘ageing’ of regular wine drinkers, 1/3rd of premium drinkers in the US are now aged 55 and over (up from 23% in 2019).

The changes become more nuanced when looking at the different attitudes and characteristics of premium wine drinkers. Wine Intelligence segments the premium wine drinking market into 3 segments: Ultra Premium, Popular Premium and Super Premium segments. Of these, the number of Ultra Premium regular wine drinkers in the US has decreased the most during Covid-19.

Ultra premiums are the youngest and highest-spending segment of US premium drinkers. They typically enjoy wine most days and have the highest wine category involvement. They are strong drivers of total wine spend, particularly in the on-premise, and enjoy actively participating in winery visits, events and publications. Ultra Premiums also spend more per bottle on wine in both the off-and on-premises compared with the other segments, by a wide margin. While wine is the primary drink of choice for Ultra Premiums, they are also core Whiskey drinkers.

During the peak of Covid in 2020, the more involved wine drinkers – the Ultra Premium and Super Premium cohorts – tended to increase their frequency of wine purchase and consumption. These drinkers purchased wine to elevate at-home dinners (and replace their previous on-premise drinking), and moved more to supporting their local or favourite wineries.

By contrast, primarily socially-driven drinkers – Popular Premiums and some Super Premiums – found themselves drinking less wine during Covid, with fewer social occasions at which to enjoy wine, they dominant wine occasion.

Popular Premiums make up almost half of the premium wine drinking population. The oldest of the premium wine drinker segments, Popular Premiums typically enjoy wine 1-3 times a week and usually spend $15-20 in the off-premise. Experience with wine has built up over time, resulting in a more settled and less adventurous wine repertoire.

While there are clear differences in quality, price and imagery perceptions of wine from different origins among premium US drinkers, there are some similarities in wine attitude – such as the relationship between the premium drinker and sustainable or organic wine.

Although premium wine drinkers are aware of sustainable and organic wines, these are not key factors that currently drive purchase. Instead, they’re seen as more ‘nice to have’ additions to wine rather than a key driver of purchase. This is in line with a wider trend seen amongst regular wine drinkers in other markets as well – with drinkers believing that standard wine practices are already ‘sustainable and natural’.

Most premium wine drinkers are now returning to their pre-Covid consumption patterns as they return to on-premise drinking. However, these drinkers are now reporting that they are more mindful of their health in relation to alcohol consumption levels overall.